Understanding Personal Finance: The Road to Financial Independence

Personal finance and budgeting are crucial life skills that enable people to achieve financial stability, lessen financial stress, and protect their futures. They go beyond simply managing money. In this thorough manual, we'll examine the fundamentals of personal finance, delve into the finer points of budgeting, and provide you with useful tips for taking charge of your financial situation.

Part 1: Understanding Personal Finance

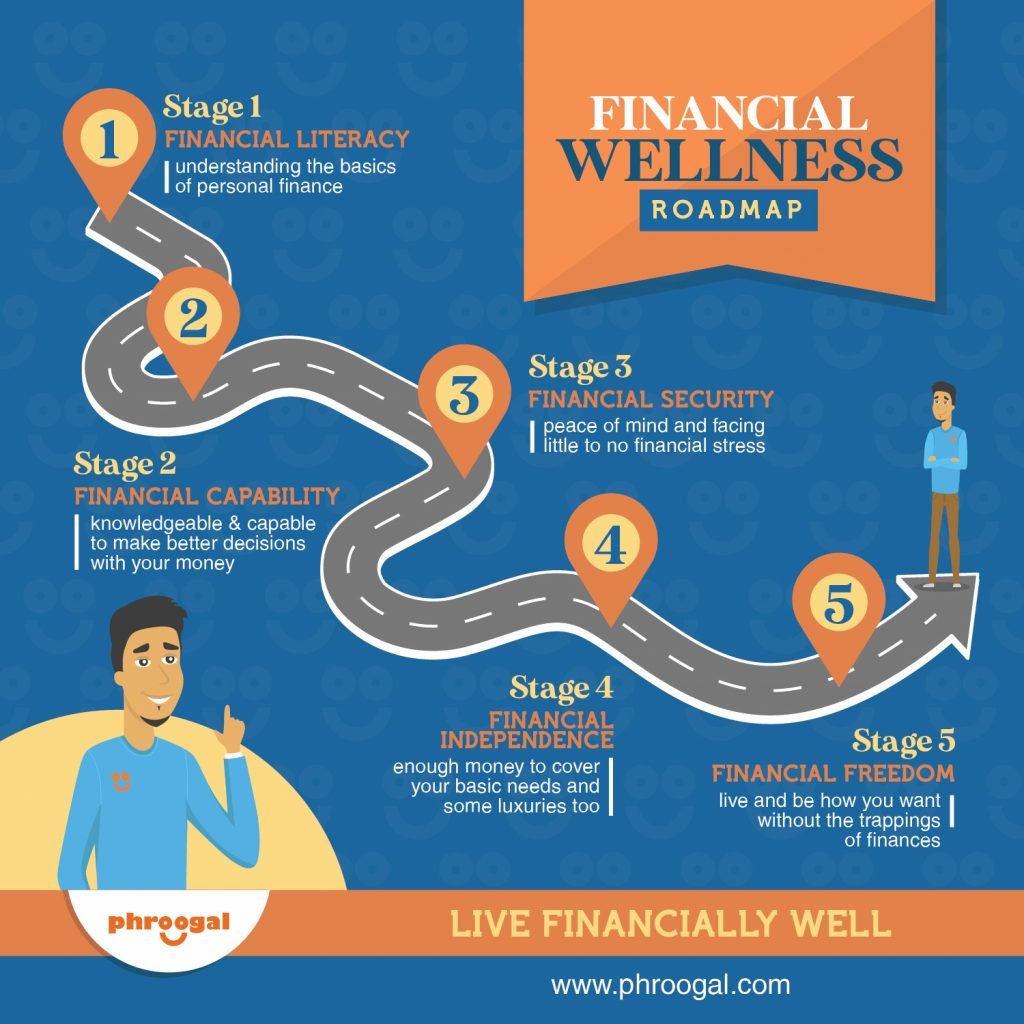

1. Financial Literacy - The Key to Success:

At the heart of personal finance lies financial literacy. Understanding key concepts like income, expenses, assets, liabilities, and net worth is crucial. Educate yourself on budgeting, saving, investing, and debt management to make informed financial decisions.

2. Assessing Your Financial Situation:

Start by assessing your current financial standing. To determine your net worth, subtract your assets from your liabilities. This snapshot will give you a clear understanding of where you stand financially and serve as a benchmark for future progress.

3. Setting SMART Financial Goals:

Create SMART financial goals—specific, measurable, achievable, relevant, and time-bound. Whether it's saving for a down payment on a house, building an emergency fund, or planning for retirement, well-defined goals provide direction and motivation.

4. The Importance of Emergency Funds:

Because life is erratic, unanticipated expenses could occur at any time. Building an emergency fund equivalent to three to six months' worth of living expenses provides a safety net, ensuring you can weather financial storms without derailing your long-term plans.

Part 2: The Art of Budgeting

1. Creating a Budget that Aligns with Your Values:

Budgeting is not about restricting yourself; it's about aligning your spending with your values and goals. Begin by tracking your income and expenses for a few months to identify patterns and areas where you can cut back or reallocate funds.

2. Different Budgeting Methods:

Explore various budgeting methods such as the 50/30/20 rule, zero-based budgeting, or the envelope system. Find the one that resonates with you and suits your financial needs and preferences.

3. Automate Your Savings and Investments:

Make saving and investing a priority by setting up automated transfers to your savings and investment accounts. This "pay yourself first" approach ensures that you save before spending, fostering financial discipline.

4. Be Mindful of Debt:

While some debt can be beneficial, such as a mortgage or student loans, high-interest consumer debt can be detrimental to your financial health. Prioritize debt repayment, starting with the highest interest loans, and consider consolidating or refinancing to reduce interest costs.

Part 3: Building Wealth through Investment

1. Understanding Investment Vehicles:

Educate yourself on various investment options, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, and retirement accounts (401(k), IRA). Your portfolio should be diversified to spread risk and perhaps maximize returns.

2. Risk Tolerance and Investment Strategy:

Assess your risk tolerance to determine your comfort level with potential investment fluctuations. Your age, financial goals, and time horizon will influence your investment strategy. Seek professional advice if you're unsure about where to invest.

3. Harness the Power of Compound Interest:

Start investing early to take advantage of compound interest, which allows your money to grow exponentially over time. Even small, consistent contributions can lead to substantial long-term gains.

Part 4: Navigating Life Events

1. Major Milestones and Financial Planning:

Life is filled with significant events, such as marriage, having children, buying a home, or retirement. Anticipate these milestones and adjust your financial plan accordingly. Consider life insurance, estate planning, and saving for your children's education.

2. Prepare for Retirement:

Retirement may seem far away, but it's never too early to start saving for it. Contribute to retirement accounts, take advantage of employer matching programs, and explore other retirement savings options to secure a comfortable future.

Conclusion:

Mastering personal finance and budgeting is a transformative journey that leads to financial freedom and peace of mind. By understanding your financial situation, setting goals, creating a budget, and investing wisely, you can take control of your financial future. Embrace the process, seek continuous learning, and adapt your financial strategy as your circumstances evolve. Remember, building wealth is not an overnight endeavor, but a lifelong pursuit that paves the way for a brighter and more secure future.